Making Payments

- Understand the costs involved

Before you choose how to make payments, find out about all the fees you will have to pay. For example, if you send money via your phone, ask the mobile money agent about the fees. Only use the service when you are comfortable with the costs. - Keep your personal information secure

- Protect your personal information e.g. names, address, signature (e.g. on cheques) and PIN (e.g. for ATMs /mobile phone payments/credit card) from being stolen. Destroy or burn confidential documents you don't need any more.

- Don't share your PIN or secret code, password or signature, since this could allow someone else to access your money.

- Find out from your financial institution/bank about the process for replacing a lost or damaged card, cheque book or other document.

- Know who you are paying

When making payments, make sure that the money is going to the right person. Check for the correct name, number and amount and keep the receipt, payment slip or confirmation message to prove that you have paid.

MOBILE PHONE PAYMENTS

- You can make payments using your mobile phone

Most mobile phone companies offer mobile payments products, enabling you to do the following directly with your mobile phone:- Send money to other people (e.g. to your family or friends),

- Pay water and electricity bills,

- Pay for fees (e.g. some schools offer you to pay school fees via mobile phone),

- Pay other businesses which allow you to make payments using your mobile phone.

- Register to make payments using your mobile phone

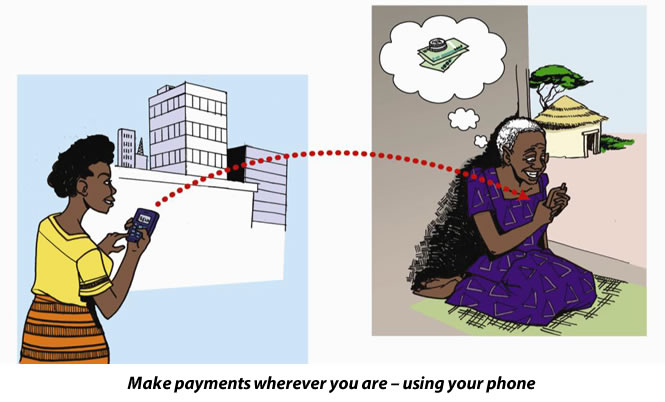

To be able to make payments using your mobile phone, you need to register for the services with your mobile phone operator. To register, you need passport size photographs and proof of identification. - Make payments wherever you are – using your phone

The big advantage of using the mobile phone to make payments is that you can use the service wherever your mobile phone company has coverage. This saves you time and the cost of travelling to the nearest bank branch. It works well for any mobile phone user in both rural and urban communities.

- Keep your PIN separate from your mobile phone

Do not keep your PIN and phone in the same place. Make sure nobody gets to know your PIN. If they do, they can steal your money. - If you access your bank account using your mobile phone, make sure you know the charges

Some banks enable you to access your bank account via your mobile phone. Bank customers can then use their phones to:- Check their account balance

- Make transactions (e.g. making payments, transfer money to another account, etc.) If you use this service, make sure you know the charges.

- Understand the costs involved

Most banks today have Automated Teller Machines (ATMs), where you can use a card to withdraw up to a certain amount of money whenever you need it. The ATM card saves you from moving around with cash. This reduces the risk of your money being stolen. - Know your ATM

Get to know the ATM you use so that you are able to recognise changes to the machine as some thieves may place gadgets on the ATMs to steal your personal information. Don't use ATM machines with warnings posted on the machine. They could have been tampered with.

- Keep your PIN secret

Don't tell anyone else your Personal Identification Number (PIN). Don't let anyone else see your PIN when you enter it at an ATM. If anyone else knows your PIN, they might be able to draw out money from your account. If you think that someone else has found out your PIN, then change it immediately. If someone else entrusts you with their PIN, treat it as you would your own and keep it secret. - Report retained ATM cards immediately

If the ATM keeps your card, call the bank immediately. If the bank is close by and open, you can also report to one of the officers there. Do not ask a stranger to help you get your card back.

- Use cheques to make safer payments

It is risky to move around with large sums of cash. Your money could get stolen or you could be tempted to spend it without having planned to do so. A cheque allows you to transfer money safely.

- Keep your cheque book safe to minimise the risk of losing money

You need to keep your cheque book safely to prevent its loss, theft or damage. If your cheque book is stolen, someone might forge your signature and steal your money. - With a cheque, you don't get your money immediately

If you are paid by cheque, it will take up to four working days (i.e. excluding weekends and public holidays) before the money shows on your account. - Make sure your signatures look alike

Make sure that the amounts and signatures on the cheque are correct and consistent. If your signatures don't look alike or look different from the one the bank has in its records, the bank will not cash your cheque. - Do not pay a cheque unless you are sure you have enough money in your account

Before you give out a cheque, check that there is enough money in the account from which thenmoney will be paid out. It is a criminal offence to issue a cheque when there isn't enough money in the account. You will have to pay a fine and could face up to six months in prison.

DEBIT AND CREDIT CARDS

- You can make payments with a Debit or Credit card

Debit cards are linked to your bank account so that the money you spend is automatically deducted from your account. With debit cards you are less likely to overspend than if you use a credit card. Credit cards allow you to use someone else's money (the card issuer's) to buy goods and services and you can pay the money back later. You should note that if you don't pay back within the agreed time, you will have to pay interest. For example if you spend.100,000/= which you pay back in one year at an annual interest rate of 20%, you will pay back a total of 120,000/=. These two cards can be used to make payments in some of the bigger supermarkets, shops, schools, hotels and anywhere else where they are accepted. They are also needed for on-line transactions.

- Beware of credit card fraud!

Beware of credit card fraud. Avoid punching your credit card identification number into websites you are not sure of while buying online. Criminals might get access to your credit card information. Look for a padlock symbol on the bottom right of the browser window – in the frame of the browser, not in the web page itself. This suggests that the site is secure, but it's not a guarantee, and it doesn't mean that the seller is honest. - Understand the fees before getting a credit card

Before deciding whether to apply for a credit card, make sure that you understand all the fees involved. There are various possible fees: application fees, cash advance fees, transaction fees, late payment fees, balance transfer fees, finance charge, penalty fees, over-the-limit fees and annual or monthly fees.

EFT AND RTGS

- You can transfer larger amounts safely and timely with Electronic payment systems like EFT and RTGS

The Electronic Funds Transfer (EFT) system enables customers to transfer money from one account to another account electronically. Real Time Gross Settlement (RTGS) transfers money from a payer's account through Bank of Uganda system to the payee's account. Inquire with your bank about the details.